Cracking the Code: Why Traders Mismanage Trades and How to Fix It

Mastering Trade Management: Key Lessons for Success

Recently, I had a chat with one of my trader buddies, and he confided in me, saying:

"You know, Sensei, I'm pretty adept at spotting great opportunities. I mean, I recently took a trade that surged by more than 60% in just a month. But here's the catch – I f*ed it up. I inexplicably exited the trade a mere day after entering. As I looked back through my trading journal, it hit me that I'd made this same mistake over and over again. I'm truly frustrated with myself. Is it a lack of discipline? Should I delve into psychology books to address this?"

In our conversation, I realized that this isn't an isolated problem my friend faces; it's a common hurdle for many traders, myself included.

So, rest assured, it's not just about being labeled "undisciplined," and you don't necessarily need to dive into psychology books to tackle this issue.

I'd like to share some insights gained from my own trials and errors, which have helped me address this challenge of mishandling my trades.

Let's delve into these solutions.

1. Create Your Trading Setup Database

I get it; you've probably heard this advice before. Building a database or playbook is a common refrain in trading. However, understanding why and how this practice benefits you is crucial. It's the "why" that drives motivation and action. Let's delve into the reasons.

First and foremost, a well-structured database provides you with a clearer perspective on your trading edge. It helps you answer fundamental questions:

What is your trading setup?

Why does it work for you?

How do stocks typically behave when your setup triggers an entry?

Under what circumstances does your setup tend to fail?

When does it perform at its best?

These are just a few questions a trading database can address.

You might wonder, "Sensei, can't I save time by studying other traders' past trades and learning their lessons?" It's a valid question.

However, keep in mind that no two traders are identical. Every trader has their unique approach – from their trading setups, entry and exit strategies, risk tolerance, preferred timeframes, temperaments, and the markets they trade. A full-time trader's approach differs from someone who balances trading with other income sources. There's no one-size-fits-all.

While you can certainly gain insights from other traders' experiences, if your goal is to move from the rollercoaster of wins and losses to consistent success, you must conduct your research. You need to discover what works best for you, aligning with your needs and expectations.

Remember, you can't trade on borrowed conviction. Your path to success demands building your own conviction. If you're unsure about how to build your trading database, I recommend checking this video from the KQ where he discussed about his setup, and why it’s important to build your trading database. It can provide you with valuable guidance.

One crucial revelation from my deep dive into my trading database was the realization that I often got stopped out of trades due to my use of relatively tight stops. In the past, my knee-jerk reaction was to avoid looking at the names that had recently stopped me out. However, this approach was a grave mistake because I didn't fully understand my trading system.

What I uncovered is that the setups that triggered stop losses often reset and materialize just a few sessions later, eventually delivering the move I had initially anticipated. In essence, being stopped out on a trade doesn't necessarily mean that my thesis was flawed. It's more a case of the stock not being ready at that specific moment. Unless the setup is completely broken, and the trend has genuinely shifted, my focus should be on keeping these stocks on my priority list rather than blacklisting them.

As I mentioned earlier, every trading system is unique, and the key is to identify the recurring mistakes that have been limiting your expected results. This introspection can only be achieved by delving deep into your database and understanding your trading intricacies. It's not about avoiding losses at all costs but about maximizing your potential gains while maintaining a calculated risk management approach.

2. Avoid Overcomplicating Your Trading Rules

Here's the deal: once you've identified a strategy that works for you, the natural progression is to refine your rules as your market knowledge deepens. This process is essential for improving your results.

However, things can go awry when you shift your focus from making money to being overly concerned with being right. That's when you risk over-optimizing your rules, creating a strategy that's too rigid.

Don't get me wrong, there's nothing inherently wrong with having a well-defined system based on long-term market tendencies. The issue arises when you over-fit your strategy, leading you to concentrate excessively on short-term market movements, often driven by your personal beliefs about the market.

And, here's the catch – those beliefs might not always hold true.

This is precisely why simplicity is the name of the game. Having fewer checkboxes to tick before making crucial decisions, such as buying and selling, determining position sizes, deciding when to stay on the sidelines, and when to be more active, can be a game.

Using an abundance of parameters or rules increases the risk of overfitting your strategy, which can ultimately hinder its effectiveness. Remember, the market won't adapt to your rules; you need to adjust your rules to align with the general market tendencies.

In trading, simplicity can be your greatest ally. Keep it straightforward and adaptable, and you'll be better positioned to thrive in the ever-evolving world of finance.

I would highly recommend giving this article a read if you want to understand more about Curve fittting, the degree of freedom, and pitfalls for backtesting.

William Eckhardt: The Man Who Launched 1,000 Systems

Tips to Avoid Overfitting:

Tip 1: Simplify Trade Management

A handy rule of thumb while crafting your trading rules is to keep trade management as straightforward as possible. Let your trades unfold naturally without hasty intervention, whether they move in your favor or not.

Here's the golden rule: be generous to your winning trades and ruthless with your losing ones. When a trade displays signs of success, it's common for traders to fear it might reverse or hit their stop-loss. Consequently, they often cut their winners short. However, if a trade begins positively, your objective should be to let it run its course without prematurely cashing in during minor pullbacks.

Let your winning trades breathe and give them the chance to reach their full potential. This approach can make a significant difference in your trading results.

Tip 2: Avoid Impulsive Decisions

Impulsive decisions in trading seldom lead to favorable outcomes. It's essential to steer clear of making on-the-spot choices while the market is live. Instead, focus on preparing your trades and trade management decisions in advance. Typically, you'll discover that outside of trading hours, your mind is clearer, and you can make decisions with less emotional interference.

However, there are situations where you might feel compelled to make an impromptu decision, especially in terms of managing a trade. For instance, you're in a stock that had an impressive first day and closed well, but the following day sees a significant decline in the second half, approaching your breakeven point. At this point, the fear of turning a profitable trade into a loss can be overwhelming.

When faced with this scenario, it's best to exercise patience. Instead of immediately closing the trade, wait until the end of the trading day (EOD). Take time to reassess the situation. Determine whether this decline is merely a regular retracement. If you still believe the stock has potential, set the pullback day's low as your stop.

If the stock is strong, it generally won't breach the low of the pullback day. If it does, then it's time to exit the trade.

By following this approach, you'll manage your trades from a position of strength, rather than letting emotions take the lead. More often than not, you'll find that refraining from impulsive exits yields better results, especially when market conditions align with your trading strategy.

Tip 3: Conquer the Fear Mindset

Most people trade with a scared mindset, they are scared when they put on a trade, and they are scared if it moves in their favor thinking what if it falls back, they are scared if it doesn’t move in their favor.

In essence, they operate from a mindset of scarcity.

Their primary focus isn't on capturing significant market moves; instead, they're fixated on limiting losses. This is particularly true for those who have a trading strategy but struggle to find consistency.

Here's the catch: because of this fear, they often prematurely cut short their winning trades.

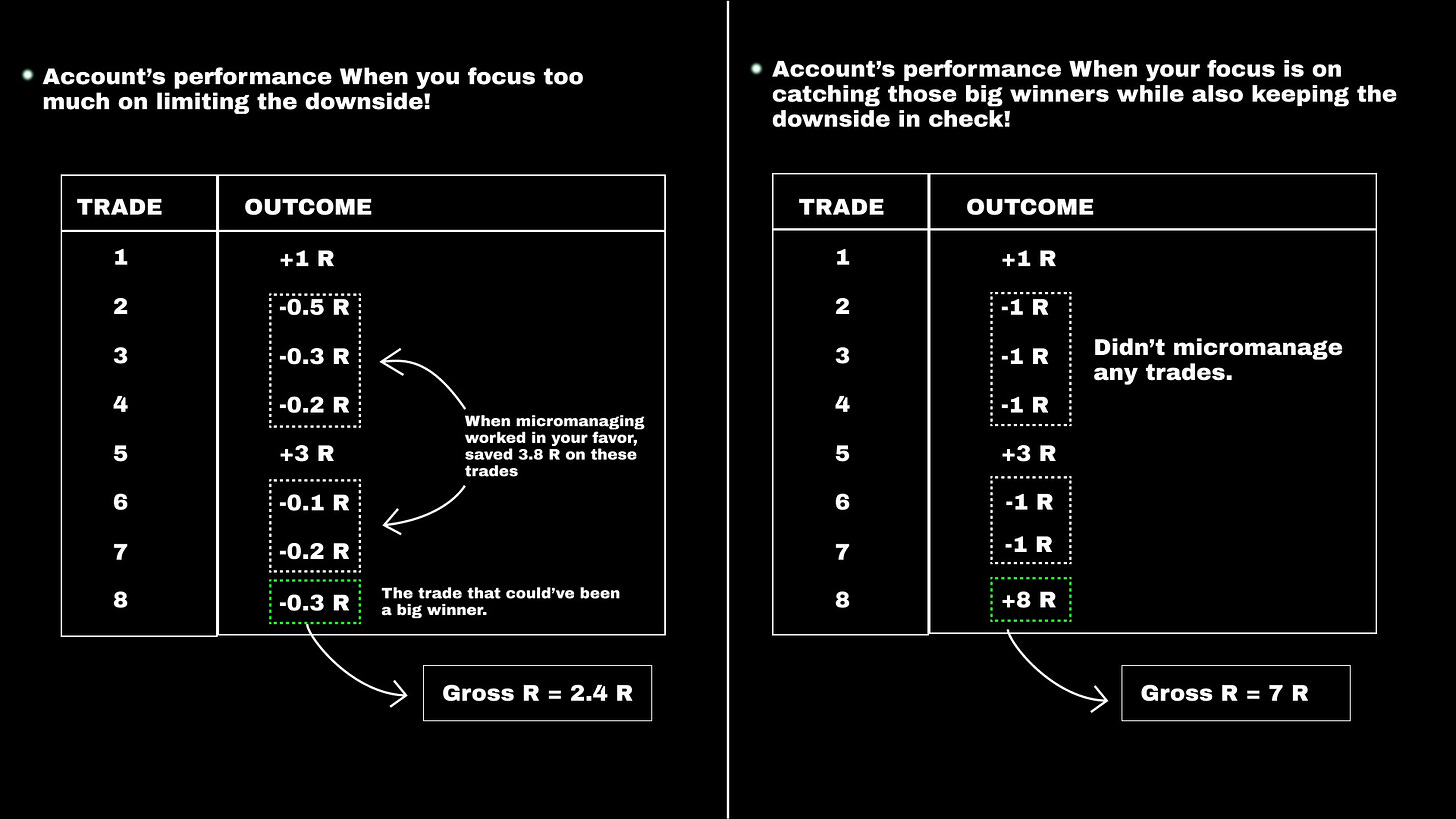

But consider this: in most trend-following systems, only a small portion, roughly 10-20%, of your trades will generate the bulk of your profits. Mismanaging these significant trades can severely diminish your strategy's potential.

Think about it – you're taking full losses while simultaneously restricting your profits. It's an absurd paradox.

Cut your losses short, yes, but don't prematurely close out your trades. While it's essential to minimize downside risks, it's equally vital not to curtail your significant winners prematurely because you aim to entirely eradicate risk. There will always be some level of risk associated with a trade; you can reduce it but cannot eliminate it. Endeavoring to do so is futile.

So, rather than fixating too much on reducing losses and avoiding losing trades at all costs, shift your focus to enhancing your top-line performance. Let those substantial trades play out. Remember, in trading, "scared money doesn't make money." Embrace a more confident and opportunistic mindset, and you'll be better poised to seize those lucrative opportunities.

Alright, folks, it's time to wrap this up. Thanks for taking the time to read my stuff. stay curious, stay fabulous, and let's keep the fun going. Catch you in the next post!

Great write up,

Keep up the good work

Keep writing ser